August 18, 2020

Cattle prices are running about $14 per cwt or 10% below projections made in the beginning of the year. That said, some July and early-August strength in the deferred live cattle futures market helped lift feeder cattle futures. Current feeder cattle futures values, for all contracts, have risen to the upper side of their lifetime trading ranges. Those are notable gains against the backdrop of the backlog of fed cattle caused by COVID-19 packing plant disruptions.

To overly simplify, think of feeder cattle as finished cattle five to seven months forward. Depending on placement weight and rate of gain, feeder cattle purchased in early November, for example, will be sold for slaughter the following March through May.

Estimating feeder cattle value

Again, to overly simplify, use the live cattle futures price five to seven months forward to estimate value of the finished animal. Estimate costs to feed the feeder animal from placement to slaughter weight. Subtracting estimated cost to finish the animal from projected value of the finished animal gives estimated value of the feeder animal.

On Aug. 7, November 2020 feeder cattle futures traded at $146.975 per cwt, a $4.25 premium to August feeder cattle futures. This is the largest price spread for the lifetime of these 2020 contracts. April 2021 live cattle futures are trading at a $9.875 and $6.250 premium to the October and December 2020 contracts, respectively. The rise in corn futures at $3.20 to $3.41 from December 2020 to May 2021 is relatively modest, so feeder cattle futures prices seem in line relative to live cattle futures. This is some buoyancy relative to what futures markets suggested in April.

July dynamics are a good indicator of the market. Still, sales in August and September will suggest where the fall market may be headed. Downward pressure could exist if drought conditions persist or worsen.

The key this year may be maintaining flexibility in marketing calves so you’re able to move calves when profitable windows open. Try to avoid being stuck in a historic all-or-none marketing strategy. Flexibility may be fundamental to regaining some value that has been lost, but those losses are yet to be realized since cattle are still on the farm. Facility space, workable weaning dates and relatively low feed costs will help.

Will putting on more gain pay?

This situation brings to light the question of when to market this year’s calf crop and if putting weight on calves is worth the time, effort and additional capital.

Looking at 525-pound, medium and large frame, No. 1 muscled steers is a good base for most producers in Iowa. Consider the case of weaning a 525-pound calf in mid-September, October or November, backgrounding the calf for 50 or 75 days, and then marketing the calf at 625 pounds or 675 pounds, respectively.

Thus, a steer weaned in mid-October and backgrounded 50 days will be marketed as a 625-pound steer in early December. A 75-day backgrounding phase will put the calf being marketed in late December to early January at 675 pounds.

It is important to note that these backgrounding scenarios assume an average daily gain of 2 pounds per day. This may be above or below what a producer shoots for when backgrounding, depending on frame and sex of their calves and feed resources available.

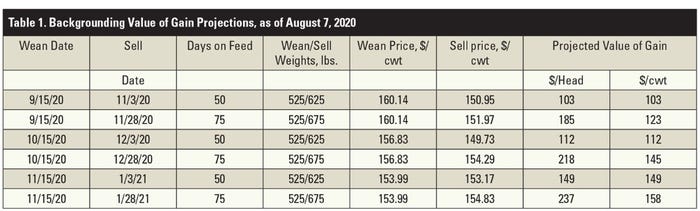

Table 1 shows value of gain projections generated by the BeefBasis forecasting tool. The forecasting model is based on feeder cattle and corn futures prices and other variables. Estimates are derived for the Dunlap, Iowa, market.

Considering the 50-day backgrounding period, the projected value of gain from mid-September to early November is $103 per cwt. The October to December ($112 per cwt) and November to January ($149 per cwt) periods are a bit more favorable.

Looking at the 75-day backgrounding period, carrying 525-pound steers to 675 pounds from mid-September to late November has a projected value of gain of $123 per cwt. This equates to $185 per head for 1.5 cwt, or 150 pounds. The value of gain from mid-October to late December is projected at $145 per cwt, while the value of gain projection from mid-November to late January is $158 per cwt.

These backgrounding projections compare favorably with current cost-of-gain estimates. Using a conservative (fairly high for backgrounding) average cost of gain of $82 per cwt, provided by the Kansas State University Focus on Feedlots June survey, suggests a total cost of gain of $82 per head and $123 per head for 100 pounds and 150 pounds of gain, respectively. The key to fall backgrounding margins will likely be the size of the carry in the feeder cattle market.

Preconditioning typically pays

It is important to note these value of gain projections presume no premium at marketing. According to statistics from the Iowa Veterinary Medical Association, producers have realized a $2 to $6 per cwt value from preconditioning calves prior to sale. A quick comparison of Iowa Cattlemen’s Association Sanctioned Preconditioned Sales at the Sheldon Livestock Auction market last year suggests preconditioning premiums were strong even in a softer overall calf and feeder cattle. The Livestock Marketing Information Center estimated 2019’s cow-calf return above cash costs plus pasture rent was the poorest since 1996. The causes were persistently low cull cow prices and weak fall calf prices. Also, returns to finishing calves were predominately negative.

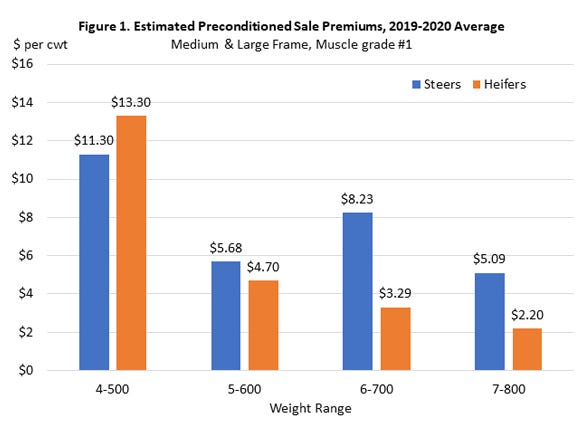

Figure 1 displays the average price premium for calves sold in the Sheldon preconditioned sales vs. regular sales. Precondition sales occurred on Dec. 13 and Jan. 3. Regular auction sales in Iowa occurring the week of and the week following the preconditioned sale were considered for comparison and provided by the Iowa Weekly Cattle Auction Summary reports published by the Iowa Department of Ag Market News.

This is only a cursory analysis of preconditioning premiums. Many factors drive calf and feeder cattle prices including sale-lot characteristics (weight, lot size, sex, color, frame, muscling, health status, seller reputation), market characteristics (futures prices, transportation costs, feedlot capacity utilization) and seasonality.

The value of preconditioning calves depends upon selling weight. Premiums (difference between precondition and regular sale prices) are generally greater for lighter-weight calves. This is no surprise as heavier calves are somewhat “preconditioned” even if they are not certified as preconditioned. That is, expectations would be that these calves are past the weaning stress period and are bunk-adjusted.

Preconditioning value

Except for the 400- to 500-pound weight range, the premiums for preconditioned heifers were lower than for steers last year. In some past years, premiums for heifers were larger than for steers and was likely due to heifers not being purchased as feeders but as replacement animals.

However, heading into 2020, the cattle inventory cycle had already entered a period of stabilization, or possibly the beginning of contraction, which likely limits heifer retention and, in turn, limits the premium on preconditioned heifers. The events of the first half of 2020 likely did not change the trajectory and could have possibly accelerated reductions in the cow herd.

If a producer proactively markets preconditioned calves this year, achieving premiums suggested by last year’s sales, then projected value of gains would notably increase. All inputs should be factored into calculating the cost of backgrounding or a preconditioning program. These include feed, operational infrastructure, equipment, labor, veterinary care and supplies, and possibly price risk management. Evaluating all these expenses will help in identifying the value proposition presented by holding cattle.

Even with all that’s gone on so far in 2020, fall-weaned calves look to still see a price similar to 2019. Fourth quarter could be even higher than a year ago. Factors driving the market include drought, the demand from feedlots, the economics of calf-feeding, winter forage prospects and optimism regarding fed cattle prices at time of marketing.

Holding cattle a few extra months may be worth the risk this year. Remember lower prices are not necessarily a negative unless you are marketing cattle during one of the periods in which prices are moving lower.

Schulz is the ISU Extension livestock economist. Email [email protected].

About the Author(s)

You May Also Like