Before we get into financial and managerial accounting, we need to discuss accrual basis. Accrual basis is important for farming operations because it focuses on profit.

The main premise of accrual accounting is that revenue is recorded when earned and expenses are recorded when incurred; and there is a difference between those and when you receive or make cash payments.

Accrual basis uses accounts on the balance sheet – think prepaids, inventory, accrued interest, payroll liabilities – to record transactions when there is a difference in timing between when the revenue/expense is earned/incurred (for accrual basis) and when the cash payment is received/made (for cash basis). Remember that “REVENUE – EXPENSE = PROFIT”; so by capturing those expenses and then releasing them when we earn the income, we know what profit is for that product.

We are going to walk through one grain season to show how to use these accounts and transactions to get profit when you sell your grain.

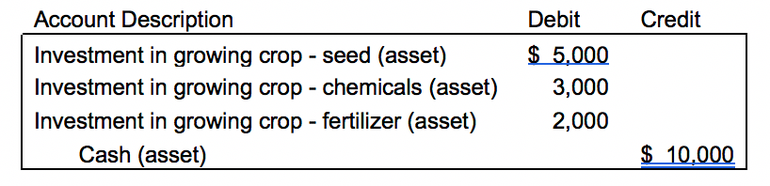

For simplicity sake, we are going to buy all of our seed, chemicals, and fertilizer in May 2019, put them in a mixer, combine everything together, pour them in a spreader, and spread it out on your field (I’m being sarcastic but hopefully you see the point). We paid cash for all of our inputs but are they really expenses? Not yet because we don’t have anything we can sell. Here’s what those transactions look like:

Note how all the transactions hit an asset account; it’s an asset because we are creating it. Think of it as work-in-progress.

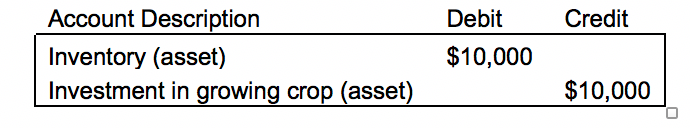

Alright, so October 2019 comes around and you harvest your grain and put it in the bin. Should we expense the seed, chemicals and fertilizer now? Not quite – we haven’t sold it yet but we have something we can sell so we can’t keep it in “Investment in growing crop” anymore:

Our inventory has the same value as the investment in growing crop as that is what we’ve put into it; there are accounting standards that would increase or decrease the value of the inventory here depending on the market but that’s another conversation.

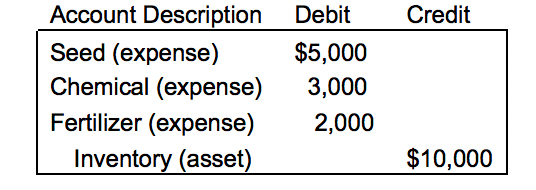

In January 2020, Guy comes along and wants to buy all the grain in your bin for $15,000 cash (I grew up by the Field of Dreams so just let me go with it). The first part of our transaction is to release the expenses from inventory because we sold our asset:

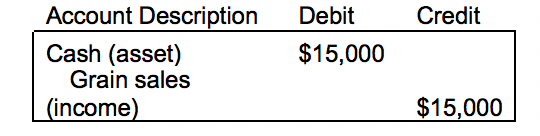

The second part is to record the sale:

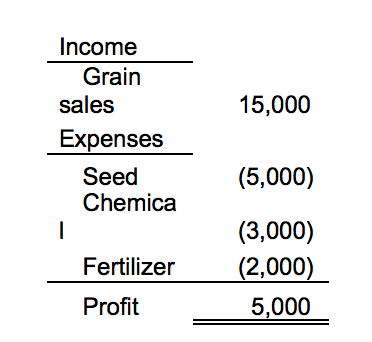

Before we kept everything on our balance sheet because we were creating something to sell. Now that we’ve actually sold it, we created our income statement for one crop season.

If we would have used cash basis accounting, our expenses would have been recorded in 2019 and income in 2020, which is fine for cash basis but – if you do financial reports on the calendar year like most people – your income and expenses are in separate periods. With accrual accounting, the income and expenses all hit the income statement in January; this is what allows us to determine profitability because they are all in the same period.

Cash is king but you need to be profitable to keep doing what you love.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like