The domestic production of sugar in the U.S. originates from sugarcane harvested in Florida, Louisiana, and Texas and sugarbeets harvested across the Upper Midwest, Central Plains, Mountain states, Pacific Northwest, and California.

Sugarcane is harvested from October to March and sugarbeets are harvested in the late summer through fall, except for California where sugarbeets are harvested in the spring through the summer.

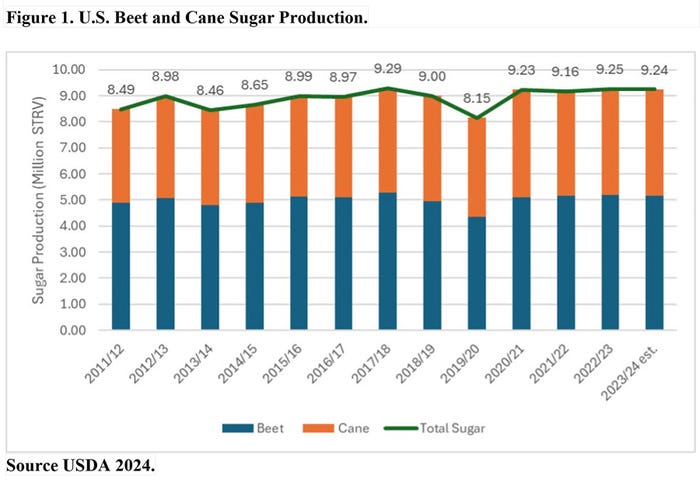

Earlier this year, USDA forecasted a record domestic sugar crop for fiscal year 2023/24, which is from October 2023 to September 2024. The USDA later lowered its FY 2023/24 forecast to 9.24 million short tons raw value (STRV) of sugar (Figure 1) because of unseasonably warm weather in the Upper Midwest and a severe drought in Louisiana and Texas.

U.S. beet sugar production for FY 2023/24 is now estimated at 5.17 million STRV, which is consistent with previous FYs (Figure 1).

Early forecast

In earlier USDA reports, the beet sugar production forecast was as high as 5.41 million STRV, but unseasonably warm temperatures in the Red River Valley during the months of December and February led to a portion of sugarbeet piles having to be discarded due to spoilage.

This contributed to increased beet shrink, which rose from 7.88% in February to 9.00% in March, and decreased sucrose extraction which fell from 15.26% to 15.02% month-over-month. As a result, USDA lowered projections of beet sugar production this year, from 5.41 million STRV in January to 5.17 million STRV in March (a reduction of almost 240,000 tons in two months).

U.S. cane sugar production for FY 2023/24 is estimated at 4.07 million STRV. This would be the highest level of cane sugar production since FY 2019/20. Increases from the state of Florida and a better-than-expected crop in Louisiana (which was hard hit by drought during the growing season) contributed to FY 2023/24’s production eclipsing last year’s level.

Prior to the onset of drought conditions in Louisiana, the state was poised to post its third consecutive year of strong, record setting production, overtaking Florida for two consecutive years for the first time. However, current estimates of cane sugar production from Louisiana are down about 65,194 tons from last year’s production to 1.94 million tons.

Texas drop

Lastly, the lack of both rainfall and irrigation water for agricultural producers in the Rio Grande Valley of South Texas over the past several years has caused cane sugar production from Texas to fall from as much as 169,000 STRV in 2017 to as few as 40,000 STRV this year. In February, the Board of Directors from the Rio Grande Valley Sugar Growers announced that this would be the last year of cane sugar production in Texas.

Given the uncertainty regarding the administration of the 1944 Water Treaty between Mexico and the U.S., which governs water sharing on both the Colorado River as well as the Lower Rio Grande, growers could not count on irrigation water supply, making purchasing crop insurance uncertain and making necessary investments into the sugar mill and farming operations too risky, according to USDA.

In total, U.S. sugar production in FY 2023/24 is estimated to be 9.24 million STRV, which would be the third largest crop behind FY 2017/18 (9.29 million STRV) and last year’s crop (9.25 million STRV).

With expected domestic demand of 12.6 million STRV and some exports going to Mexico, total use is projected at 12.7 million STRV which would suggest ending stocks of 1.7 million STRV, and a stocks-to-use ratio of 13.4%, all else being equal.

Stocks-to-use

On average, the USDA’s estimates of ending stocks-to-use have been low in March relative to the final estimate in December by 1.2% over the past six years, suggesting a final stocks-to-use of approximately 14.6%, and ending stocks of 1.85 million STRV, or 3.7 billion pounds of sugar.

Even though U.S. sugar producers have seen their input costs rise by more than 30% since the last Farm Bill, the U.S. is still the fifth largest producer of sugar in the world producing more than 9 million STRV of sugar.

With 12.5 million STRV of sugar consumption, the U.S. is also the third largest importer of sugar in the world. How these dynamics interact with sugar markets and sugar policy will be addressed in a future Southern Ag Today article.

Source: Southern Ag Today, a collaboration of economists from 13 Southern universities.

About the Author(s)

You May Also Like