Recent developments in Argentina's corn industry have sparked uncertainty as the discovery of corn stunt disease casts a shadow over production forecasts. Initially anticipated to yield large quantities, the impact of this disease is causing a reassessment of expectations.

This shift has implications not only for Argentina's agricultural sector but also for global markets, particularly in the United States.

The forecasts and the shift

Earlier this year, optimism ran high with predictions of a robust corn harvest in Argentina for 2024. Buoyed by favorable rainfall patterns associated with the El Niño weather phenomenon, the USDA projected record production levels of 56 million metric tons (MMT), marking a substantial increase of 56% from the previous year. Correspondingly, export forecasts were equally promising, estimated at a record 42 MMT, indicating a 66% surge from 2023.

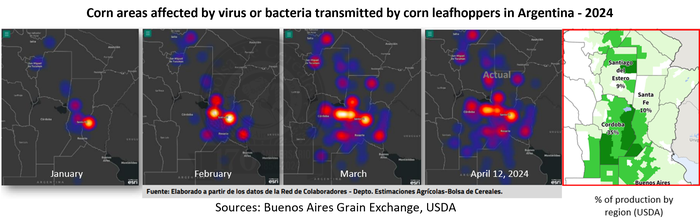

However, the landscape changed drastically in recent weeks. The emergence of a corn stunt disease, facilitated by increased pressure from corn leafhopper, is causing concern among producers in Central Argentina. While this bacterial disease has plagued Brazil for some time, its significant impact on Argentina's crops is unprecedented this season. Characterized by the development of small ears with missing kernels and reduced weight, the disease poses a considerable threat to crop yields. Compounding the challenge is the difficulty in visually identifying infected fields from a distance, making mitigation efforts arduous. Losses in affected fields could range from 15% to 100%, further exacerbating the situation.

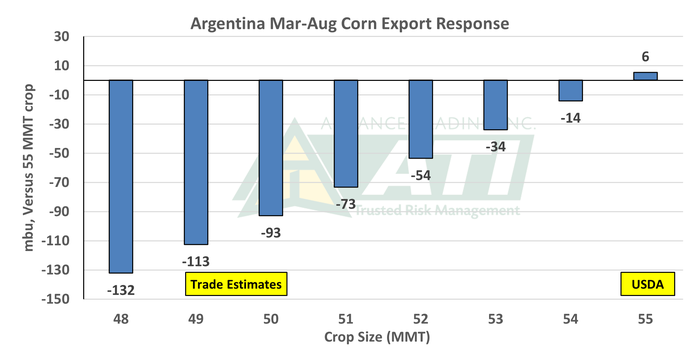

The correlation with exports

An integral aspect of this dilemma lies in the correlation between Argentina's corn production and its annual exports. A reduction in crop size directly impacts export volumes. The graph below plots the size of the Argentina corn crop (horizontal axis) and the response in corn exports to various production estimates (vertical axis). For instance, a mere 2 MMT reduction in crop size, from 55 MMT to 53 MMT, could precipitate a significant 34 mbu decrease in exports between March and August. Moreover, the timing of Brazil's safrinha crop harvest, expected between June and July, with exports likely peaking in August, adds complexity to the situation.

Implications for the market

The potential shrinkage of Argentina's corn crop not only affects domestic markets but also reverberates globally, particularly in the United States. A smaller Argentine crop could create an opportunity for increased U.S. corn exports during the final months of the 2023/24 crop year. However, this prospect also introduces additional uncertainty into the market dynamics, necessitating careful risk management strategies.

As uncertainty clouds the outlook for Argentina's corn crop, stakeholders must navigate this evolving landscape with caution. Vigilant monitoring of developments, coupled with proactive risk management measures, is imperative for mitigating potential market disruptions. In these challenging times, seeking guidance from knowledgeable advisors can provide invaluable insights and assistance in charting a course through the uncertainties ahead.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

ArgentinaAbout the Author(s)

You May Also Like