A few weeks ago I wrote about getting ready for the timing of a potential summer rally, in order to price out the remaining old crop corn farmers may still have in bins.

What’s happened

Receiving much positive feedback from the article, folks then asked me if new crop corn had any similar price patterns to be aware of, in order to forward contract new crop corn. (“Yes” is the answer, and more on that in the paragraphs to follow.)

Further conversation led to a realization that producers really want to make sure they do a great job of marketing this summer (on a potential rally) after feeling frustrated about missing high prices on old crop and new crop corn marketing opportunities that were present in late 2023 and very early 2024.

Let’s make an action plan. Here are four steps you can take now, to be ready for a potential summer rally.

From a marketing perspective

1. Get cash target price orders working now with your elevator to sell remaining old crop corn. Based on what we know right now, a 2-billion-bushel carryout is our current reality, and – barring a severe weather concern in the United States this summer – might make it tricky to see corn futures prices trade above $5.

2. Decide whether it makes sense for you to “re-own on paper” any old crop corn sales that may have been made in recent weeks. As of this writing, July corn futures are trading near $4.50. Should prices rally up to the $5 price area, do you want to try to capture some of that upside potential?

If so, consider a re-ownership strategy with call options, or an advanced option strategy that might work best for you regarding your budget and risk tolerance. Do not neglect placing exit orders immediately as well. Should prices rally to the $5 area, they may only be there for 5 minutes of one trading day, and if you have profit objective orders working, you’ll have better odds of having your order filled.

3. Get cash target price orders working now with your elevator to sell a percentage of your new crop corn. December corn futures have a broader scope historically of when the “summer price high” has occurred.

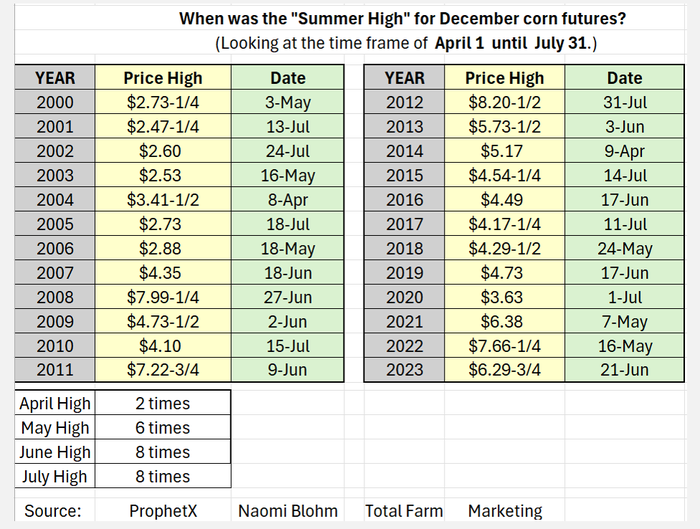

Looking back on the past 24 years over the time period of April 1 until July 31, the summer high for December corn futures has occurred twice in April. The price high has occurred six times in May, while June and July each saw a price high eight times. That’s a pretty wide net of timing for pricing opportunity.

There is definitely not a “magic date” to know when to pull the trigger.

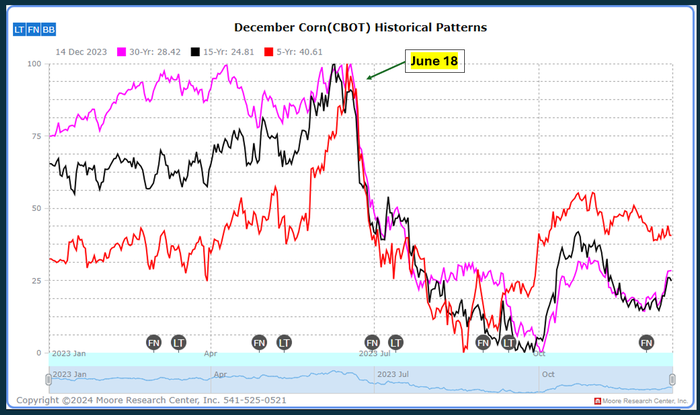

One thing to also be aware of is the December Corn Seasonal Chart. While past performance is not indicative of future results, the 5-, 15- and 30-year price patterns suggest that having a portion of your new crop priced near Father’s Day weekend may be a positive step on the marketing path.

4. Consider now how you’re going to protect “unpriced bushels” of new crop. Many of you would be comfortable forward contracting up to half of your expected new crop production, but that leaves half of your new crop then unprotected from prices falling lower. Work with your market advisor now, to create a plan to buy puts, including budget and time value needed. Also consider potentially not only protecting the 2024 crop prices, but 2025 crop prices as well.

Prepare yourself

Get ready. The bottom line is the summer price high often occurs when you’re busy wrapping up spring planting, and fretting over whether the corn crop will grow, as the upcoming summer forecast may look hot and dry.

But during those moments of uncertainty regarding crop production size and weather scares is often when the market responds and may trade higher, and you need to be ready to capture the opportunity!

Be disciplined and be ready. And remember prices often come crashing down as fast (or faster) than when they rallied, leaving you with mere days or minutes to capture the rally.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

About the Author(s)

You May Also Like