The grain market needs a friend this spring. Several sources for this helping hand were in play last week, but none really stepped forward. However, corn and soybean prices finally stabilized on Friday to keep nearby futures off March lows.

The most likely suspect usually is USDA, but April’s World Agricultural Supply and Demand Estimates came and went without much impact. The government tweaked its 2022-2023 marketing year forecasts for both crops a little but won’t start talking about new crop until May – and those initial discussions aren’t likely to provide a whole lot of assistance either.

Although hopes for a rally to help farmers holding old crop inventory aren’t dead yet, the spark for a surge is either well down the road or will take blowing up the road with headlines that are by definition unpredictable. Betting on these carries a warning too: Be careful what you wish for.

Average cash prices falter

First, the WASDE. USDA cut its forecast for old crop corn stocks a little and increased carryout for soybeans. But it reflected the trajectory of the market by dropping average cash price expectations a nickel and a dime respectively.

Projected corn stocks tightened 50 million bushels but remain big at 2.122 billion bushels. Usage for feed and ethanol both went up 25 million bushels, neither of which is unreasonable. The amount fed to livestock matches the direction suggested by March 1 quarterly grain stocks. Biofuel plants also appear to be using a little more, and recent data from the U.S. Energy Information Administration through March is actually even stronger.

As for soybeans, 20 million bushels was cut from exports. With renewed concerns about China’s beleaguered property sector, the jury is still out about whether the economy there might be over the hump.

Any bullish hope lies in new crop

So what’s left to be bullish about? Well, there’s always weather, though that is a new crop story. And, as is often the case, the El Niño cycle is the culprit.

Will La Niña fears feed higher prices?

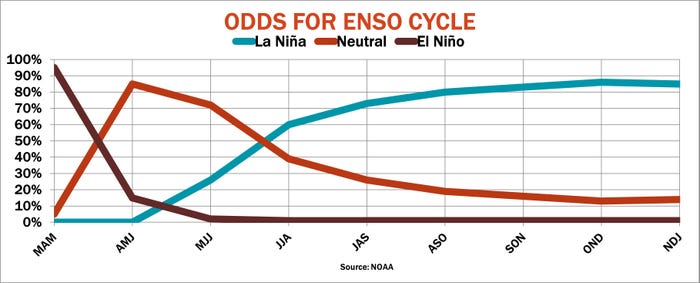

In their latest update, a few hours before the WASDE print, U.S. forecasters said the current El Niño in the equatorial Pacific should continue to weaken, transitioning to the neutral phase of the cycle this spring – but not for long. Instead, likelihood of La Niña development this summer increased 5% to 60% “La Niña tends to follow strong El Niño events, which also provides added confidence in the model guidance favoring La Niña,” the forecast read.

To be sure, not everyone agrees with this outlook. Contrasting views from private forecasters hit my email inbox in short order. A shift to La Niña cooling of the equatorial Pacific during the June-August quarter is associated with lower-than-normal corn and soybean yields in the United States.

If a weak La Niña develops this summer, average yield projections for corn fall around 4% to 172 bushels per acre, while soybeans could lose around 3% to 50.8 bpa. Just the fear of such reductions could be enough to provide selling opportunities for new crop, pulling old crop higher along the way.

Now, odds for this aren’t overwhelming by any means, but they are better than a dice roll and are statistically significant.

Of course, the fallout from a lingering El Niño cycle readings of neutral have similar predictability. In that event, odds for above normal yields increase, with average corn yields of 183 bpa and soybeans hitting nearly 53 bpa.

So, no slam dunk. But it could rev up the market if the weather hype machine gets into overdrive.

CPI revs Wall Street

More than a few markets kicked into high gear already this spring – with inflation again in the spotlight thanks to a hotter than expected reading from the Consumer Price Index last week. The CPI isn’t the inflation gauge favored by the Federal Reserve, and nothing suggests a return to the 8.5% spike we saw in 2022. But the new data was enough to quash hopes for multiple interest rate cuts soon, with the market betting on maybe two reductions in 2023.

The idea of higher rates dropped stock prices off all-time highs, which isn’t surprising. Why take risk when you can park funds in a money market and earn 5% or more without risk? The surprise came from several other markets known for risk, including crude oil and currencies – and especially gold.

Gold kept making new all-time highs, finally reversing lower on Friday. The precious metal is the mother of all inflation hedges, but its soaring trajectory was more than that. Risk of an attack from Iran ratcheted up international tensions to be sure, and buying was also noted from central banks.

Other countries appear to be worried about a new tariff salvo following the fall U.S. election, which could impact more than China.

Crude oil, meanwhile, hit $87 a barrel in the United States, the highest since October. In addition to uncertainty in the Middle East, the energy agency in the United States raised its demand forecasts, with output from OPEC and its allies anything but certain.

The crude action was all the more surprising because of yet another market. The dollar index trade in New York hit its highest level in a year. That’s counter-intuitive because a strong currency can be bearish for commodities denominated in greenbacks, like crude.

The big rally by the dollar reflected higher interest rates, in part because investors need them to buy high-yielding Treasuries. In addition, the U.S. economy, whatever its faults, looks a whole lot better than the rest of the world right now.

But the rally also reflected a “to the mattresses” mentality, namely risk aversion. That’s making it harder to attract more commodities to the rally. Corn and soybeans could join the party, but likely will need a weather story to get an invitation.

About the Author(s)

You May Also Like