At a Glance

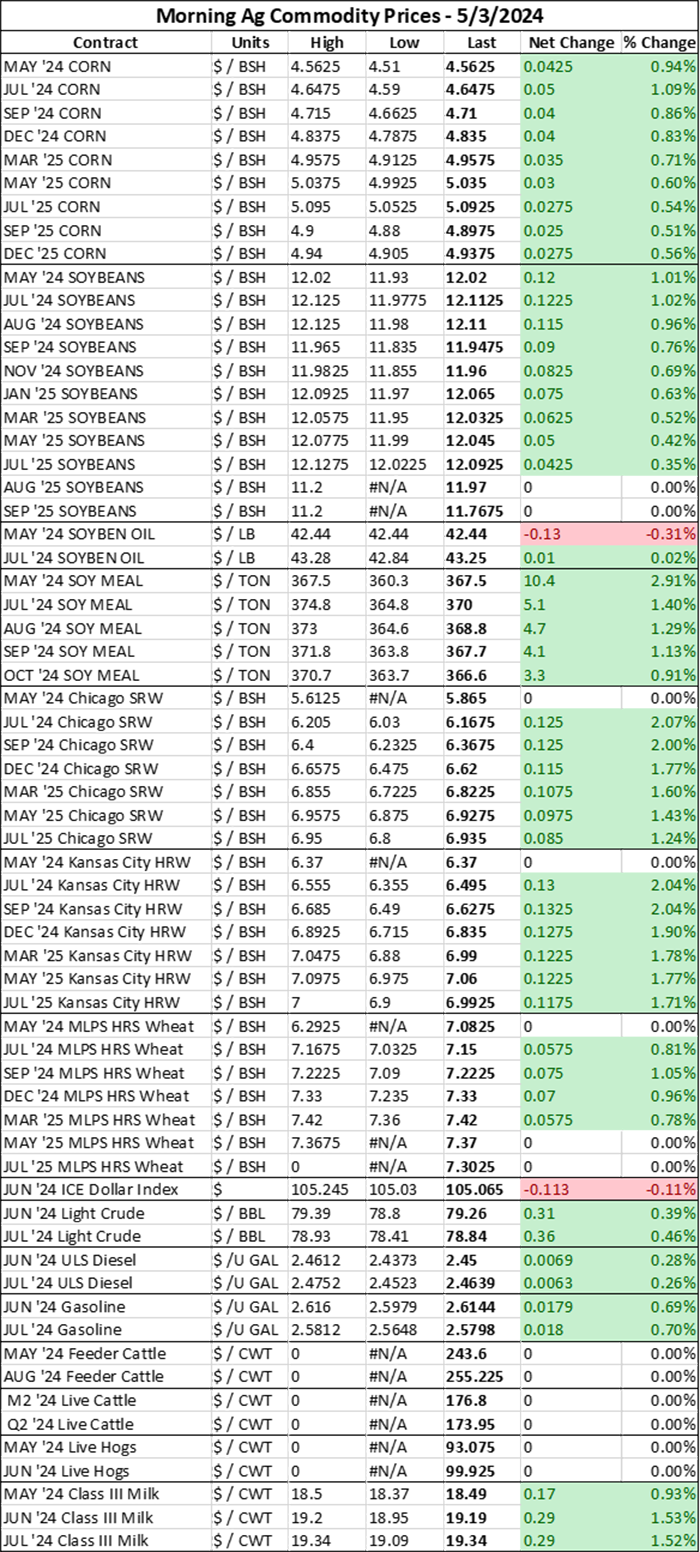

- Corn up 2-4 cents

- Soybeans up 4-12 cents; Soyoil down $0.01/lb; Soymeal up $10.40/ton

- Chicago SRW wheat up 11-12 cents; Kansas City HRW wheat up 11-12 cents; Minneapolis spring wheat up 6-8 cents

Prices updated as of 6:55am CDT.

Good morning!

Markets are continuing yesterday’s rally this morning, largely on global supply jitters.

Feedback from the Field

Were you able to dodge showers over the weekend and keep your planter rolling?! Share your insights with us in our ongoing Feedback from the Field survey!

Feedback from the Field is an open-sourced, ongoing farmer survey of current crop and weather conditions across the Heartland. If you would like to participate at any time throughout the growing season, click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country – or even across the county!

Soybeans

Global soybean supplies have taken a beating this week, but U.S. prices have been a major benefactor of those market jitters. U.S. soybean futures rose $0.04-$0.12/bushel overnight following yesterday’s rally, lifting nearby May24 futures to $12.02/bushel overnight, reflecting strength in the cash market yesterday as countryside farmer sales to end users slow during spring planting season.

Most actively traded Jul24 futures cleared the $12/bushel benchmark overnight, trading at $12.10/bushel this morning. New crop Nov24 futures are closing in on that target this morning at $12.945/bushel at last glance.

Soymeal prices surged nearly 5% higher yesterday and are trading $4-$10/ton higher this morning. Nearby May24 soymeal futures are up nearly 3% this morning to $367.5/ton while Jul24 futures settled at $369.6/ton.

Markets are digesting flooding in Southern Brazil, another looming round of strike activity in Argentina, revived crush margins in the U.S., smaller Ukrainian oilseed acreage, and rain delays during planting in the U.S. Heartland. A weaker dollar and stronger energy prices also played into the U.S. soybean complex’s favor this morning.

Even though Argentina’s oilseed and dock workers’ ended quickly this week, the world’s largest soymeal exporter is likely to face more strike pressure from its trucker and public transportation unions early next week. Soymeal futures rose nearly 5% during yesterday’s trading session as rains in Brazil and record-setting March 2024 U.S. soymeal export volumes also contributed to a very bullish run for the soy complex.

Argentine truck drivers, bus, airplane, subway, and train workers will begin strike activity on May 6 to protest President Javier Milei’s re-introduction of an income tax on sections of Argentina’s population that are largely comprised of middle-class workers in the aforementioned transportation industries.

“On May 6 in the morning hours and around noon, the activities in air, land, port, and maritime transport will be interrupted in rejection of the fiscal agreement that again sanctions the Earnings Tax,” Argentine Confederation of Transport Workers (CATT) Secretary-General Juan Carlos Schmid posted on X (the website formerly known as Twitter).

Essentially, the strike will bring anything with wheels to a halt on Monday. Not only will public transportation be closed, but grain and oilseed exports and energy supply movement will be paused.

Thursday’s soymeal rally was also aided by strengthening cash soybean markets. Soymeal demand may be taking a pause after yesterday’s rally, but end users are growing eager for fresh farmer supplies of soybeans while farmers are busy in the fields.

“Cash crush margins have fallen below break-even levels at some locations, encouraging processors to slow the production of soymeal and soyoil after several months of a record or near-record crush pace,” Julie Ingwersen reported for Reuters yesterday.

Argentina’s strike and Brazil’s weather problems will likely remain bullish for the soy complex over the next few days. If U.S. soymeal supplies begin to run lower on poor crush margins and Argentina’s strike activity lasts longer than just early next week, then we could continue to see strength build for soymeal futures in the coming days.

Brazil’s southern regions have been battling heavy rain showers this week. And while that is probably a dream for safrinha corn crops approaching peak pollination in the area, for soybean producers trying to get late-planted beans harvested, the torrential downpours have been a nightmare.

"It's the time of year where we talk about rain makes grain, but also rain makes mud," Don Roose, president of U.S. Commodities, told Reuters yesterday afternoon.

To be sure, most of Southern Brazil’s soybean crops have been harvested. The region’s crop agency, Emater, found 66% of Rio Grande do Sul’s soybean crop had been harvested by April 25. First crop corn harvest was 82% complete at that time. But quality issues are emerging as farmers try to wait out the rains and local devastation has been widespread and severe.

These relentless showers have caused flooding and infrastructure issues. At least 13 people in the Southern Brazilian state have died, with 21 more individuals listed as missing.

"These very voluminous rains, with no sunny breaks to harvest (grains), always end up causing quality losses," Adriano Gomes, a grains analyst at consultancy AgRural, told Reuters yesterday.

More rain is expected in Southern Brazil over the weekend. Temperatures are also trending cooler than average. Both of these factors will make it difficult for saturated soils to take on more water, even though the weekend rain accumulation is not expected to be as heavy as in recent days.

The rain showers propped up gains in the soybean complex yesterday.

Corn

Corn prices edged $0.02-$0.04/bushel higher this morning, with nearby May24 futures rising to $4.5625/bushel, most actively traded Jul24 contracts trading up to $4.64/bushel, and new crop Dec24 prices settling at $4.83/bushel at last glance. The price upticks are being largely derived from weather and disease worries in South America, as well as potential strike activity expected in Argentina next week that could slow export paces.

The morning’s gains were also supported by a weaker dollar and higher energy prices, but were limited by favorable planting progress and rain outlooks in the U.S., which should help support yields

While Southern Brazil is facing a massive flooding event, which is only expected to increase in severity over the weekend, hot and dry weather in Central Brazil is intensifying, creating crop stress for safrinha corn crops during peak pollination periods.

Argentina’s Buenos Aires Grains Exchange issued another cut to its ongoing 2023/24 corn harvest, knocking over 118 million bushels off its last estimate to bring the forecast to nearly 1.831 billion bushels.

Weather woes and leafhopper damage were cited as the primary drivers of the yield downgrade. Argentina is the world’s third largest corn exporter, so the recent news that its 2023/24 corn crop is facing damage as peak harvest activity ramps up has had a bullish impact on corn prices.

Wheat

A weaker dollar and continued worries about Black Sea supplies kept U.S. wheat price gains alive as the week came to a close. U.S. wheat futures rose $0.05-$0.12/bushel at last glance, sending nearby Chicago wheat futures above the $6/bushel benchmark for the second time this week.

Rain forecasts in Russia earlier this week suggested that key growing areas in the world’s largest wheat exporter would see relief from drought conditions that are causing crop stress and likely yield and quality losses. Overnight, Russian ag consultancy IKAR downgraded its 2024 Russian wheat production estimates by 2% to 3.343 billion bushels (91MMT), which led it to also reduce 2024/25 Russian export prospects by 3% to 1.855 billion bushels.

USDA will release its estimates for 2024/25 global production, supplies, and consumption in next Friday’s WASDE, which should provide the markets more clarity about the impacts of reduced Russian production on the global balance sheet.

But until that point, markets are keeping a close eye on Russian rain forecasts. Rains that were expected in the Southern Russia earlier this week did not end up falling nor providing any measure of meaningful drought relief for the region.

But updated forecasts are suggesting that dry conditions are likely to remain in place in Southern Russia over the next two weeks. We could see further crop downgrades in the coming days if those forecasts hold true – Russia’s wheat crops are in peak grain fill stages right now so the lack of soil moisture could exacerbate drought stress and limit yield potential.

Weather

Temperatures will continue to run above average into the middle of next week, according to NOAA's 6-10-day outlook, but only for the area east of the Southern Plains to the Upper Midwest. At that time, temperatures will trend below average for the Western Plains and Pacific Northwest, though they will continue to run warm further east. Above average chances for showers will continue to stretch across the upper two-thirds of the country, with the Northern Border and the Great Lakes region experiencing the highest chances of accumulation.

Warm temperatures will continue recede through late next week in NOAA’s 8-14-day forecast. During that time, the High Plains and Upper Plains will battle below average temperatures, while the Upper Midwest sees more seasonal norms with regard to temps. The Southern Plains through the Eastern Corn Belt will still be enjoying warmer than average temperatures next weekend. Moisture forecasts are once again projecting an above average chance for widespread showers across the Heartland during that time, with the Southern Plains and Southeast enjoying the highest chances for moisture.

It's not idyllic planting weather forecasted into next week, so farmers can expect to continue dodging showers as they race to complete planting activities.

Farm bill

On Wednesday, Congressional ag leaders announced they would soon be considering farm bill proposals, raising hopes that last year’s extension of the 2018 Farm Bill would be short-lived. Policy editor Joshua Baethge chronicles Wednesday’s announcement and analyzes the various responses.

“While a new bill this year is far from certain, most agree that any sign of progress is a good thing,” Baethge writes. Baethge also emphasizes that cautious optimism is the best approach to take when reading these announcements, noting that differing proposals highlight divergent priorities across the ag world.

The proposals promote sustainable agricultural production, maintain conservation practices, create more opportunities for young and beginning farmers, and strengthen the farm safety net, without sacrificing nutrition security measures – a rare winning proposal for everyone.

“Still, after months of little movement, the push for a new farm bill seems to be gaining momentum,” Baethge adds. “Maybe.”

What else I’m reading at www.FarmFutures.com this morning:

Naomi Blohm examines if we’ve hit the “spring low” for corn prices.

My latest E-corn-omics column takes a quick look at major market factors for corn, soybean, wheat, and fertilizer markets.

Policy editor Josh Baethge summarizes the Biden administration’s new sustainable aviation fuel standards and shares some of the challenges farmers may face with the program.

Analyst emeritus Bryce Knorr is watching these four marketing items as peak planting season ramps up.

Just like in the NFL draft last week, AgMarket.Net hedging strategist Tyler Schau recommends farmers stick to their strategy when it comes to grain marketing plans.

About the Author(s)

You May Also Like